Textile Sector Pakistan: Comprehensive Industry Analysis and Growth Prospects 2024-2025

Pakistan’s textile sector is the backbone of its economy, contributing 8.5% to GDP and employing millions of workers across spinning, weaving, dyeing, and garment production. With exports crossing USD 17.88 billion in FY2025, the industry represents more than 60% of Pakistan’s total exports. It is not only the largest employer in the industrial sector but also the country’s strongest connection to global markets.

Understanding the textile sector Pakistan means looking beyond numbers. It involves examining its role in the global supply chain, the challenges it faces from energy shortages and rising costs, and the opportunities it has through policy reforms and market diversification. This blog provides a complete picture of the sector’s performance, competitiveness, and outlook for 2024–2025.

Table of Contents

Pakistan Textile Sector Overview and Economic Significance

Industry size and GDP contribution

The textile sector accounts for approximately 8.5% of Pakistan’s GDP, with a network of more than 1,200 ginning units, 442 spinning units, and hundreds of weaving and garment factories. The scale of the sector makes it one of the most vital contributors to national economic stability. According to the Pakistan Bureau of Statistics, textiles consistently dominate export revenue, keeping the sector at the center of trade policy discussions.

Employment figures and workforce demographics

Between 15 to 25 million people are directly and indirectly employed in Pakistan’s textile sector. This represents around 40% of the country’s industrial labor force. Cities like Faisalabad, Lahore, and Karachi act as the main employment hubs. Women also form a growing part of the workforce, especially in garment stitching and finishing lines, though challenges in wages and working conditions persist.

Export share and role in Pakistan’s economy

Textiles account for more than 60% of Pakistan’s total exports. Cotton yarn, knitwear, bed linen, towels, and denim are among the most sought-after products. The All Pakistan Textile Mills Association (APTMA) emphasizes that sustaining exports requires competitive energy tariffs, modernization, and improved cotton yields. Without these, Pakistan risks losing ground to regional competitors like Bangladesh and India.

Current Textile Sector Pakistan Performance Metrics

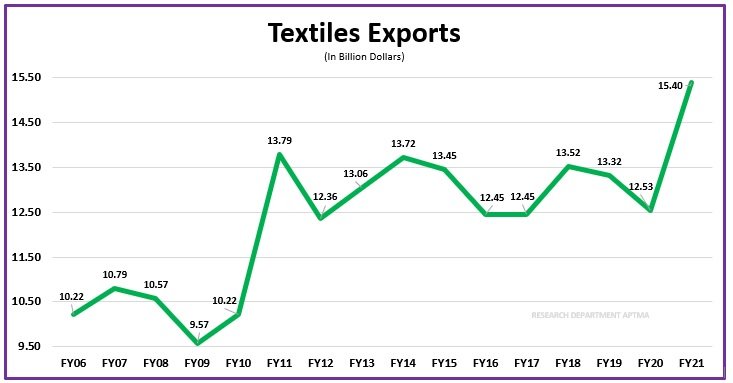

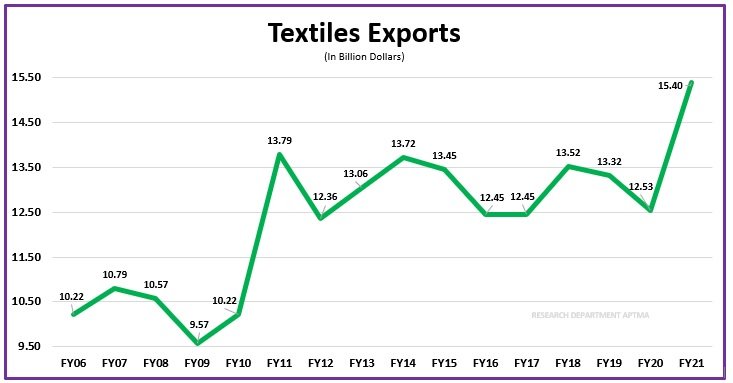

FY2025 export achievements and statistics

In FY2025, Pakistan’s textile exports rose by 7.39%, reaching USD 17.88 billion. This surge was led by strong demand in knitwear and ready-made garments. According to Dawn News, July alone saw a 32% year-on-year jump in exports, signaling a recovery phase despite inflation and energy cost pressures.

Product categories: yarn, garments, home textiles

The industry’s output covers a wide range of categories:

- Cotton yarn and fabric – base raw materials that fuel the value chain

- Knitwear and readymade garments – major drivers of export revenue

- Bedwear, towels, and home textiles – critical segments for EU and US markets

- Denim – Pakistan ranks among the top global suppliers

Regional manufacturing hubs: Faisalabad, Karachi, Lahore

Faisalabad is often called the “Manchester of Pakistan” for its concentration of spinning and weaving units. Karachi leads in large-scale garment manufacturing and export logistics due to its port access. Lahore is a rising hub for apparel brands and vertical integration models. These clusters play a crucial role in keeping supply chains agile and export-ready.

Pakistan Textile Sector Manufacturing Infrastructure

Spinning and weaving capacity

Pakistan has one of the largest spinning capacities in Asia with more than 10 million spindles installed nationwide. The spinning sub-sector dominates the textile value chain by producing cotton yarn, a base product for weaving and garment industries. Weaving is also extensive, with both power looms and hand looms contributing to production. However, inefficiencies in older machinery reduce competitiveness compared to regional rivals like India and Bangladesh.

Value-added segments: garments, knitwear, denim

The true strength of the textile sector Pakistan lies in value-added categories. Knitwear, readymade garments, and denim account for the majority of export revenue. Global buyers increasingly prefer vertically integrated companies that handle spinning, dyeing, and garment stitching under one roof. Firms like Interloop Limited and Gul Ahmed lead this transition by focusing on high-quality exports and diversified product ranges.

Technology adoption and modernization

Modernization is critical for competitiveness. While large exporters are investing in Industry 4.0 technologies, including automation and digital production systems, a large portion of the sector still depends on outdated machinery. According to the Trade Development Authority of Pakistan, low technology adoption is one reason Pakistan lags behind Bangladesh in apparel exports. Upgrading to energy-efficient machinery could help reduce production costs and improve quality standards.

Major Export Markets and Global Competitiveness

Top export destinations (US, UK, Germany, China)

The United States remains Pakistan’s largest textile buyer, accounting for 26.42% of total exports. The United Kingdom and Germany follow with double-digit shares, while China is both a buyer and competitor. These markets demand consistent quality and competitive pricing, pushing Pakistan’s manufacturers to adapt rapidly to changing trade dynamics.

Pakistan vs Bangladesh and India competitiveness

While Pakistan enjoys an edge in cotton production, Bangladesh has overtaken it in apparel exports due to stronger investment in ready-made garments and better labor productivity. India also poses competition with a broader product mix and advanced textile machinery. To close this gap, Pakistan must strengthen its value-added exports and improve efficiency across the supply chain. Comparative reports from UNCTAD highlight how energy tariffs and policy support are shaping regional competitiveness.

GSP+ and trade agreements impact

Pakistan benefits from the European Union’s GSP+ status, which allows duty-free access for most textile exports. This status has been a major driver of growth in knitwear and home textile shipments to Europe. However, maintaining GSP+ requires compliance with labor and environmental standards, making sustainability initiatives crucial. Trade agreements with China and other Asian markets further diversify export opportunities, but strong competition requires strategic positioning.

Key Challenges Facing Pakistan Textile Sector

Energy crisis and RCET policy implications

The textile sector Pakistan has long struggled with high energy costs and frequent supply shortages. Electricity and gas make up a significant portion of manufacturing costs, making competitiveness dependent on government policies such as the Regionally Competitive Energy Tariffs (RCET). According to APTMA, failure to maintain RCET can increase costs by up to 25%, causing export orders to shift to other countries.

Cotton production decline and raw material issues

Despite being a major cotton-growing nation, Pakistan has faced declining cotton yields due to climate change, pests, and poor seed quality. The country now imports significant volumes of cotton, raising costs for local manufacturers. A report by the Pakistan Institute of Development Economics (PIDE) highlights that reliance on imported cotton has weakened Pakistan’s cost advantage in global markets.

Inflation, rising costs, and global slowdown

Inflation and currency devaluation have increased input costs, from dyes and chemicals to machinery parts. Global economic slowdowns also impact demand, particularly from European and North American buyers. Without structural reforms, these challenges risk eroding Pakistan’s competitive edge.

Government Policies and Support Measures

Textile and Apparel Policy 2020-2025

The Textile and Apparel Policy sets targets for export growth, modernization, and skill development. It aims to increase exports beyond USD 20 billion through incentives for value-added products, tax relief, and modernization financing. The Ministry of Commerce highlights diversification into technical textiles and synthetic fibers as critical for future growth.

RCET (Regionally Competitive Energy Tariffs)

Introduced to offset high production costs, the RCET program provides energy to textile manufacturers at regionally competitive rates. However, inconsistent implementation creates uncertainty. The PIDE RCET study shows that stable tariffs could add billions to annual exports.

Export incentives and financing schemes

Exporters receive duty drawbacks, financing facilities, and tax rebates. The State Bank of Pakistan offers concessionary loans for modernization. However, many SMEs find it difficult to access these schemes, which often favor large exporters.

Leading Pakistani Textile Companies and Exporters

Top 10 textile exporters and their performance

Pakistan’s textile exports are dominated by a handful of large players. Companies such as Nishat Mills, Gul Ahmed, Artistic Milliners, and Soorty Enterprises have built strong reputations for quality and reliability. They lead in denim, knitwear, and home textiles, driving Pakistan’s global presence.

Vertical integration and value chain strategies

Many successful exporters are vertically integrated, controlling everything from spinning to finished garments. This reduces costs, improves quality control, and allows faster order fulfillment. Interloop Limited, for instance, supplies socks and hosiery to global giants like Nike and Adidas through a fully integrated supply chain.

Innovation and sustainability leaders

Forward-looking companies are investing in water recycling plants, renewable energy, and sustainable fibers. For example, Artistic Milliners runs one of the region’s largest solar-powered textile factories. Such initiatives not only reduce costs but also meet the compliance demands of buyers in Europe and North America.

FAQ: Pakistan Textile Sector

What percentage of Pakistan’s GDP comes from textiles?

The textile sector contributes around 8.5% to Pakistan’s GDP, making it one of the largest industries in the economy.

How many people are employed in Pakistan’s textile industry?

Between 15–25 million people are employed directly and indirectly, accounting for roughly 40% of Pakistan’s industrial workforce.

Which countries buy Pakistani textiles?

The main buyers are the United States, United Kingdom, Germany, Netherlands, and China. The US alone imports over 26% of Pakistan’s textile exports.

What are the biggest challenges in Pakistan’s textile sector?

High energy costs, declining cotton production, inflation, and global competition are the major challenges. Policy consistency and modernization are essential for future competitiveness.

Future Outlook and Growth Prospects

Diversification of export markets

While the US and EU remain dominant markets, opportunities are growing in East Asia, Africa, and the Middle East. Diversification will reduce risk from over-dependence on traditional buyers and open new avenues for growth.

Industry 4.0 and digital transformation

Adoption of smart manufacturing, digital design, and supply chain management systems is slowly transforming the sector. Companies integrating Industry 4.0 technologies will be better equipped to handle global demand fluctuations and quality expectations.

Investment opportunities and expansion

The sector requires consistent investment in modernization, renewable energy, and research and development. International investors are particularly interested in Pakistan’s competitive labor costs and strategic geographic location. With policy support and stable energy pricing, Pakistan’s textile exports could cross USD 20 billion in the near future.

Conclusion: Strategic Roadmap for Pakistan Textile Sector

The textile sector Pakistan remains the backbone of the economy, but it stands at a crossroads. To secure long-term growth, the industry must address its structural challenges — from energy inefficiency and cotton shortages to global compliance standards. At the same time, opportunities exist in value-added exports, sustainability initiatives, and digital transformation. With the right mix of government policy, private sector innovation, and international partnerships, Pakistan’s textile industry can continue to thrive as a global leader.

Related Post: Minimum Wage in Pakistan 2025: Rates, Laws & Compliance

Author: ZunNurain Khalid — Travel & Tourism Specialist, Founder of ExploreX Pvt. Ltd., and advocate for sustainable tourism in Pakistan. With over a decade of experience in digital marketing and destination branding, ZunNurain has worked extensively on promoting Pakistan’s natural and cultural heritage.

References

- Pakistan Bureau of Statistics

- All Pakistan Textile Mills Association

- Trade Development Authority of Pakistan

- Kohan Textile Journal – Export Data

- UNCTAD – International Trade Reports

- Ministry of Commerce – Textile Policy

- Pakistan Institute of Development Economics

- World Bank – Industry Competitiveness

Saira says:

I am a PhD. student at University Utara Malaysia. I am doing research on textile industries performance in Pakistan. I want to know that the performance compared to 2023 the textile industry growing. Could you share the challenges that textile industries faced during recession period. Also, Is Accounting Information System help to make better decision making by providing quick and concise reports?

ZunNurain Khalid says:

Thank you, Saira, for your thoughtful question and for sharing the context of your PhD research.

In comparison to 2023, Pakistan’s textile industry has shown partial and uneven recovery rather than broad-based growth. While export volumes and order inflows improved in selected segments during late 2024 and 2025, overall performance remains constrained by structural and macroeconomic challenges. Growth has largely been driven by temporary factors such as currency depreciation and short-term export incentives, rather than sustained productivity or competitiveness improvements.

During the recessionary period, textile industries in Pakistan faced several major challenges, including:

• Severe energy shortages and high electricity and gas tariffs, which increased production costs

• Volatility in raw cotton supply, combined with reliance on imported cotton

• High interest rates and restricted access to working capital

• Declining global demand due to inflationary pressures in key export markets

• Policy uncertainty and inconsistent export support mechanisms

• Outdated technology and low investment in automation and value-added production

Regarding your question on Accounting Information Systems (AIS), empirical evidence and industry practice strongly support that AIS plays a critical role in improving decision-making quality. Well-implemented AIS enables textile firms to generate timely, accurate, and concise financial and operational reports, which help management in:

• Cost control and variance analysis

• Pricing and profitability decisions

• Cash flow and working capital management

• Performance evaluation across departments

• Strategic planning under volatile economic conditions

In the context of Pakistan’s textile sector, AIS adoption has become increasingly important during periods of economic stress, as it supports data-driven decisions and enhances managerial responsiveness. However, the effectiveness of AIS depends on system integration, data quality, and the managerial capacity to interpret reports correctly.

Your research focus is highly relevant, and linking AIS effectiveness with firm performance during recessionary cycles can make a valuable academic contribution. I wish you the best in your PhD journey and would be happy to engage further if needed.