What Is National Finance Commission — Pakistan’s Revenue-Sharing System

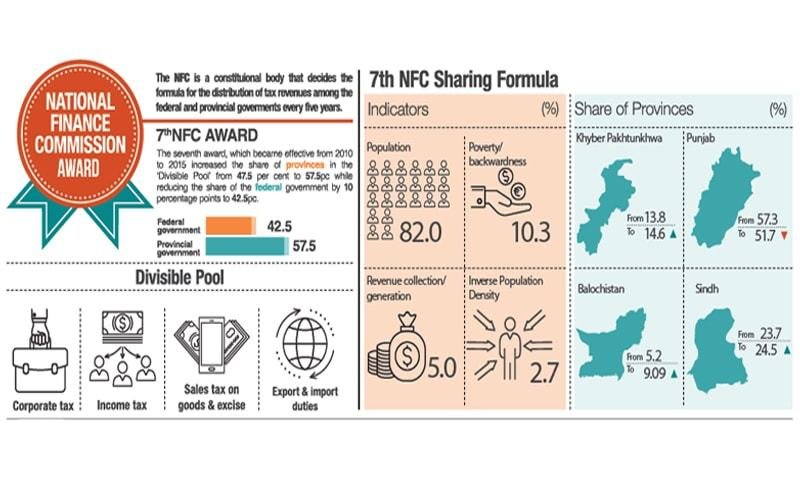

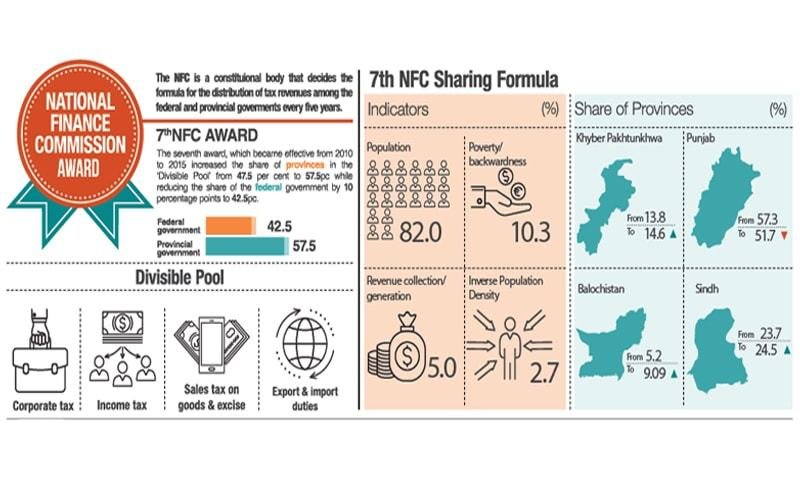

The National Finance Commission (NFC) is Pakistan’s constitutional body responsible for deciding how revenue collected by the federation is distributed between the federal and provincial governments. It ensures financial fairness, balancing the country’s fiscal needs across Punjab, Sindh, Khyber Pakhtunkhwa, and Balochistan. Every five years, the NFC reviews national revenue sources and recommends a new formula that determines how taxes from the federal pool are shared.

This process directly affects each province’s annual budget — from funding healthcare and education to developing roads and local infrastructure. Understanding what is National Finance Commission means understanding how your tax rupees move from Islamabad to every corner of the country.

- Explains how Pakistan’s national taxes are divided between federation and provinces.

- Clarifies what criteria define provincial shares and why they change over time.

- Summarizes key historical NFC awards and current updates on the 11th formation.

Table of Contents

What Is National Finance Commission? Definition, Members, and Mandate

The National Finance Commission is established under Article 160 of the Constitution of Pakistan. It includes the federal finance minister, four provincial finance ministers, and financial experts nominated by the President. The Commission’s task is to evaluate revenue sources, recommend a fair division of funds, and propose measures to enhance provincial fiscal autonomy.

Its purpose is not just to divide money but to maintain fiscal harmony among the federation’s units. The NFC addresses economic disparities, ensures predictable budgeting for provinces, and strengthens Pakistan’s federal structure through equitable distribution.

What Is National Finance Commission in Pakistan’s Constitution (Article 160)

Article 160 defines the NFC as a constitutional mechanism that must be formed every five years. It directs the President to constitute the Commission and sets the scope of its responsibilities. The article outlines that the NFC’s recommendations should determine:

- The distribution of net proceeds of taxes between federal and provincial governments.

- The grants-in-aid to provinces in need of additional support.

- Any other financial matters referred to the Commission by the President.

In simple terms, Article 160 ensures that Pakistan’s financial system adapts to changing realities by revisiting revenue-sharing every five years. It is a built-in accountability cycle that keeps fiscal federalism dynamic and relevant.

What Is National Finance Commission for Provinces: Why It Matters

Every province relies heavily on its NFC share to run public services. For instance, the 7th NFC Award allowed provinces to receive 57.5% of the divisible tax pool, significantly expanding their budgets for health, education, and infrastructure. Without this mechanism, poorer provinces would face severe fiscal constraints, widening regional inequalities.

Provincial governments use their NFC shares to fund local development, employee salaries, and social welfare programs. That’s why debates over the NFC aren’t just political — they directly affect the quality of life of millions of citizens.

What Is National Finance Commission Formula and How It Works

The NFC operates on a structured formula that divides tax revenue collected by the Federal Board of Revenue (FBR). The process has two stages: vertical and horizontal distribution. The first decides how much of the total goes to the federation versus the provinces; the second decides how that provincial share is split among the four provinces.

Vertical Distribution Under What Is National Finance Commission (Federal vs Provinces)

In the latest effective arrangement — the 7th NFC Award — provinces collectively receive 57.5% of the divisible pool, while the federation retains 42.5%. This shift from the previous 50-50 split was significant: it gave provinces greater control over their fiscal destiny while reducing the center’s share of tax revenue.

The divisible pool includes taxes such as income tax, sales tax, customs duties, and federal excise duties. The federal government still funds defense, debt servicing, and national projects from its portion, while the rest flows to provinces for local development and governance.

Horizontal Distribution in What Is National Finance Commission (Among Provinces)

Once the provincial share is determined, it’s divided among the provinces using specific criteria designed to reflect both population and economic need. The 7th NFC Award established the following weighted formula:

- Population: 82%

- Poverty and Backwardness: 10.3%

- Revenue Collection/Generation: 5%

- Inverse Population Density: 2.7%

This balance aimed to ensure that smaller and less-developed provinces like Balochistan and Khyber Pakhtunkhwa receive fairer support compared to their revenue generation capacities.

What Is National Finance Commission Calculation Method — Step by Step

The calculation can be understood in four simple steps:

- Determine total net tax collection by the FBR — for instance, Rs 12.97 trillion (FY 2024–25 target).

- Apply the vertical split: 57.5% to provinces, 42.5% to the federation.

- Distribute the provincial share using the horizontal weights listed above.

- Resulting approximate shares: Punjab 51.74%, Sindh 24.55%, Khyber Pakhtunkhwa 14.62%, and Balochistan 9.09%.

Each province’s budget then incorporates this allocation as its core revenue base, supplemented by its own taxes and grants.

Constitutional Framework of What Is National Finance Commission

The National Finance Commission functions under a clear constitutional framework that guarantees both fairness and continuity. The drafters of Pakistan’s 1973 Constitution recognized that economic disparities among provinces could undermine national unity — so they built in a legal mechanism to correct those imbalances. This is where Article 160 comes in.

Article 160 Requirements for What Is National Finance Commission

Article 160 mandates that the President of Pakistan must constitute the NFC every five years. Its primary role is to recommend how net proceeds of taxes are to be shared between the federation and the provinces. It also empowers the Commission to suggest measures for improving the financial health of the country, including adjustments in tax assignments or grants-in-aid to provinces.

Importantly, once the recommendations are approved, they become legally binding through a Presidential Order. This ensures the agreed formula remains intact until a new NFC is constituted. For reference, see the official text of Article 160.

President’s Role and Commission Procedures in What Is National Finance Commission

The President initiates the formation of the NFC by appointing members based on recommendations from the federal and provincial governments. The Commission is typically chaired by the Federal Finance Minister and includes the finance ministers of all four provinces, along with experts from the private or academic sectors.

Once formed, the NFC holds regular meetings, reviews national fiscal data, consults economists and think tanks like PIDE, and drafts recommendations. Consensus is vital; every province must agree before the award is finalized. This collaborative process reinforces the spirit of fiscal federalism enshrined in the Constitution.

Implementation and Monitoring of What Is National Finance Commission

After an NFC Award is announced, its implementation and monitoring are handled by the Ministry of Finance and the State Bank of Pakistan. These institutions release biannual reports confirming whether provinces are receiving their due shares. This transparency builds public trust and allows analysts to track compliance with constitutional commitments.

History of What Is National Finance Commission Awards in Pakistan

The concept of resource sharing between the center and provinces predates Pakistan’s Constitution. It began in 1951 with the Raisman Award, which served as the first formal revenue distribution framework in the newly independent state. That early attempt set the stage for future NFCs, eventually becoming institutionalized under Article 160.

From Raisman Award to the First NFC: The Origins of What Is National Finance Commission

The Raisman Award (1951) allocated federal revenues among provinces based primarily on population. It was a starting point for fiscal coordination in a young and evolving state. When Pakistan adopted the 1973 Constitution, this practice was made constitutional through the creation of the National Finance Commission.

The first NFC was constituted in 1974, formalizing the revenue-sharing mechanism that has since been refined through subsequent awards.

Evolution from 1st to 7th in What Is National Finance Commission Awards

Since 1974, Pakistan has witnessed seven successful NFC Awards, though not all were concluded on schedule. The earlier awards focused heavily on population as the primary criterion. Over time, new factors like poverty, backwardness, and revenue collection were introduced to make the formula fairer and more development-oriented.

The 7th NFC Award (2010) marked a major shift. For the first time, provinces collectively received a larger share (57.5%) than the federation. This change empowered provincial governments to manage devolved sectors like health, education, and social welfare following the 18th Constitutional Amendment.

Why Some What Is National Finance Commission Awards Stalled or Lagged

Not every NFC has met its constitutional five-year cycle. Political disagreements, data gaps, and differences over distribution criteria often delay the process. For instance, the 8th and 9th NFCs could not reach consensus, so the 7th Award formula continued to be used for over 15 years — far beyond its intended duration.

These delays highlight the complexities of fiscal negotiation in a diverse federation, where each province has unique economic conditions and expectations.

Current Status: 7th Award Under What Is National Finance Commission

The 7th NFC Award, signed in December 2009 and implemented in 2010, remains the operational framework for fiscal transfers today. Despite being overdue for replacement, it continues to define the revenue landscape between Islamabad and the provinces. Its design significantly increased provincial autonomy, enabling local governments to expand development programs and reduce dependency on federal grants.

Provincial Shares in What Is National Finance Commission (7th Award Snapshot)

The table below shows the percentage shares each province receives under the 7th NFC Award:

| Province | Share (%) |

|---|---|

| Punjab | 51.74% |

| Sindh | 24.55% |

| Khyber Pakhtunkhwa | 14.62% |

| Balochistan | 9.09% |

These percentages were designed to promote equity and address structural imbalances across Pakistan’s regions. For example, Balochistan’s guaranteed minimum share ensured stability even if federal revenue underperformed, as detailed in SBP’s special section on the 7th NFC.

Criteria Weights Used in What Is National Finance Commission

The formula for horizontal distribution — among provinces — introduced a multi-factor approach that reduced Punjab’s dominance and recognized development needs. The agreed weights are:

- Population: 82%

- Poverty and Backwardness: 10.3%

- Revenue Collection/Generation: 5%

- Inverse Population Density: 2.7%

This formula has been praised by economists at PIDE for making fiscal transfers more equitable across Pakistan’s four provinces.

Impact of the 18th Amendment on What Is National Finance Commission

The 18th Constitutional Amendment, passed in 2010, devolved several key ministries — including health, education, and social welfare — to provincial governments. This devolution made the NFC Award even more crucial because provinces needed higher revenue shares to manage these responsibilities. As a result, the fiscal space created by the 7th Award became the foundation for Pakistan’s modern federal model.

FAQ

What Is the 7th NFC Award in Pakistan Under What Is National Finance Commission?

The 7th NFC Award, implemented in 2010, was a landmark in Pakistan’s fiscal history. It increased the provincial share of the divisible pool from 46.25% to 57.5%, introduced new distribution criteria beyond population, and guaranteed a fixed minimum share for Balochistan. It remains in effect today because subsequent NFCs could not reach consensus on a new formula.

How Is the National Finance Commission Award Calculated in What Is National Finance Commission?

The calculation starts with total net tax revenue collected by the Federal Board of Revenue. The NFC first decides how much goes to the federation (42.5%) and how much to provinces (57.5%) — this is called vertical distribution. The provincial share is then divided among Punjab, Sindh, KP, and Balochistan using weighted criteria based on population, poverty, revenue generation, and inverse population density.

Which Province Gets the Highest Share in What Is National Finance Commission Awards?

Punjab receives the highest share — approximately 51.74% — due to its large population base. However, Sindh follows with 24.55%, KP with 14.62%, and Balochistan with 9.09%. The higher population weight explains Punjab’s leading position, while the poverty and density criteria ensure smaller provinces get proportionate support.

When Was the First Award Announced Under What Is National Finance Commission?

The first official NFC Award was announced in 1974, a year after Pakistan’s new Constitution came into effect. It institutionalized a formal system of tax revenue distribution, building on the Raisman Award of 1951. Since then, there have been seven conclusive awards, with the 11th currently under discussion.

Conclusion: A Plain-English Summary of What Is National Finance Commission and Why It Matters

The National Finance Commission is far more than a bureaucratic mechanism—it is the heartbeat of Pakistan’s fiscal federalism. By ensuring that provinces receive their fair share of national tax revenue, the NFC strengthens the country’s social contract. Every school built, hospital funded, or road repaired at the provincial level is directly tied to how the NFC distributes resources.

Today, as Pakistan moves toward its 11th NFC Award, the conversation is shifting from “how to divide the pie” to “how to grow it.” The challenge lies in balancing fairness with fiscal responsibility—empowering provinces while maintaining national solvency. Whether through new formulas, digital transparency, or incentive-based transfers, the next NFC will shape how Pakistan funds its future.

For citizens, understanding what is National Finance Commission means understanding how tax money becomes public service. Awareness of these processes encourages accountability and informed debate—essential ingredients for a strong and equitable federation.

Related Post: Textile Sector Pakistan: 2024-2025 Industry Analysis

Author: ZunNurain Khalid — Travel & Tourism Specialist, Founder of ExploreX Pvt. Ltd., and advocate for sustainable tourism in Pakistan. With over a decade of experience in digital marketing and destination branding, ZunNurain has worked extensively on promoting Pakistan’s natural and cultural heritage.

References

- Constitution of Pakistan — Article 160 (National Finance Commission)

- Ministry of Finance — 7th NFC Award Details

- State Bank of Pakistan — Special Section on NFC Implementation

- PIDE Research — Fiscal Federalism in Pakistan

- The Express Tribune — Explainer: NFC Award and Its Importance

- Dawn — Understanding the 18th Amendment and Its Fiscal Impact

- IMF — Pakistan Country Page

- World Bank — Pakistan Overview